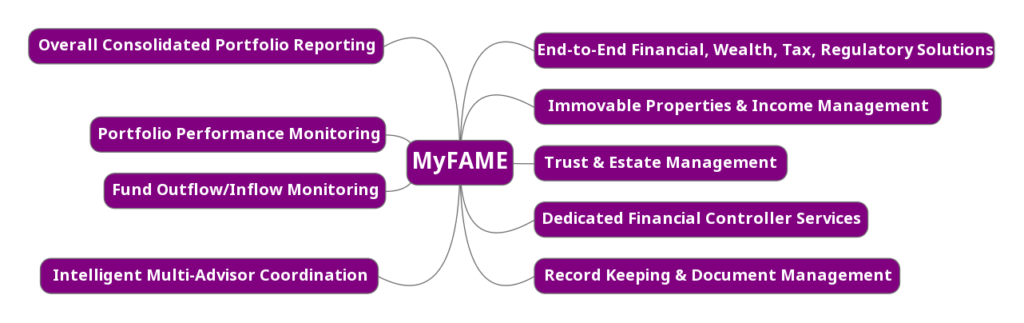

From monitoring investments, tax management, asset protection to succession planning, MyFAME helps manage all by partnering in building one’s life balance sheet.

MyFAME is a one-stop solution for HNIs wherein our team of experts take a consolidated view of the client’s assets, both domestic and international, and customise a Portfolio Management & Execution Support Service to achieve short and long term goals of the client. Other than imparting advice on how much and where to invest, which is the domain expertise of investment advisors, MyFAME manages all other aspects of the client’s financial life.

HNIs benefit from MyFAME in several ways. The key advantages are:

- Proactive coordination with investment advisors, bankers, brokers and multiple consultants on the client’s behalf, making it a convenient and smooth engagement,

- A periodic reporting mechanism designed to hold all the consultants accountable for their deliverables. These reports give an overview of the financial performance of investments, global tax and reporting compliance, documentation status on all financial transactions, asset protection, succession planning, and contract management and more.

All in all, MyFAME is your personal financial controller.

Annveshan is one of the leading Financial Support Services in South India offering a wide suite of advisory services across Financial Planning, Due Diligence, Tax Advisory, Estate and Succession Planning to individuals and businesses.