Services

Professional Assistance in Evaluating Finance, Tax, and Regulatory Risks

These services involve conducting comprehensive investigations and assessments to evaluate the financial, tax, and regulatory compliance of a business or transaction. These services are typically performed by specialized firms or professionals to identify potential risks, liabilities, and opportunities associated with financial, tax, and regulatory matters

Due diligence services on finance, tax, and regulatory matters are crucial in assessing the financial health, tax compliance, and regulatory adherence of a business or transaction. By conducting thorough investigations and assessments, businesses can mitigate risks, identify opportunities for improvement, and ensure compliance with applicable financial, tax, and regulatory requirements

-

Financial Due

Diligence -

Tax Due

Diligence -

Regulatory Compliance

Due Diligence -

Compliance with Industry

-specific Regulations -

Identification of Risks

and Opportunities -

Reporting

and Recommendations

We review and analyze the financial records, statements, and reports of a business to assess its financial health, performance, and risks. This includes examining historical financial data, identifying key financial metrics, analyzing revenue and expense patterns, evaluating profitability, and assessing the quality of assets and liabilities. Financial due diligence helps in understanding the financial position of a business, uncovering potential issues, and validating financial representations made during a transaction.

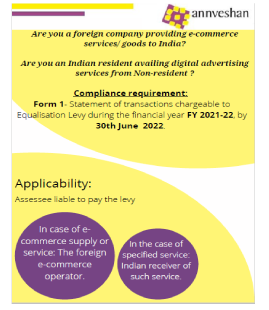

We conduct a thorough examination of a business’s tax compliance, obligations, and exposures. This involves reviewing tax returns, tax provisions, tax positions, and relevant tax documentation. The objective is to identify any potential tax risks, liabilities, or contingencies that may impact the business’s financial position. Tax due diligence helps in assessing the accuracy and completeness of tax reporting, understanding potential tax exposures, and evaluating the tax implications of a transaction.

Regulatory compliance due diligence focuses on assessing a business’s adherence to applicable laws, regulations, and industry-specific requirements. This involves examining compliance with government regulations, licensing requirements, permits, environmental regulations, consumer protection laws, data privacy laws, and other relevant regulations. The purpose is to identify any potential violations, regulatory risks, or non-compliance issues that may impact the business’s operations or reputation. We carry out these for certain commercial regulations only.

Depending on the industry or sector in which the business operates, due diligence may include assessing compliance with specific industry regulations, such as financial services regulations, healthcare regulations, energy sector regulations, or telecommunications regulations. Industry-specific due diligence ensures that the business is compliant with the unique regulatory requirements and standards applicable to its operations.

Through the due diligence process, we identify potential risks, liabilities, and opportunities associated with the financial, tax, and regulatory aspects of a business or transaction. We provide a comprehensive assessment of the strengths, weaknesses, and potential areas of improvement. This information helps stakeholders make informed decisions, negotiate transaction terms, and develop risk mitigation strategies.

Upon completion of the due diligence process, we prepare a detailed report summarizing their findings, observations, and recommendations. The report highlights any identified risks, liabilities, or compliance issues, along with suggested actions to address them. This enables stakeholders to understand the potential impact on the transaction or the business and make informed decisions based on the due diligence findings

Publications

Union Budget 2017

Know More

Union Budget 2018

Know More

Union Budget 2019

Know More

Union Budget 2020

Know More

GST ON DIRECTOR’S REMUNERATION

Know More

TReDS

Know More

Demands, Refunds and Rectifications

Know More

Faceless Assessments, Tax Charter and Honouring the honest

Know More

Fee for Technical Services – Is the reduced rate of 2% applicable to you?

Know More

Startupindia

Know More

MCA OFFERS A BREATHER DURING COVID TIMES

Know More

RREEGGIISSTTRRAATTIIOONN NGO-DARPAN

Know More

Compliance for international transactions with Associated Enterprises

Know More

26AS-Know your 26AS(KY26AS)

Know More

Labour Codes & Its Impact on Business

Know More