Tax Planning &

Strategy Services

Best tax planning and strategic service provider in Bangalore

- Tax Compliance

- Tax Optimization

-

Entity Structure

Planning -

International

Tax Planning -

Mergers, Acquisitions,

and Restructuring -

Estate and Succession

Planning -

Tax Controversy

and Audit Support -

Tax Education

and Training

We assist individuals and businesses in meeting their tax compliance obligations. We ensure that tax returns are prepared accurately and submitted on time, in compliance with relevant tax laws and regulations. We stay up to date with tax law changes and help clients navigate complex tax requirements.

We work with clients to identify tax planning opportunities that can optimize their overall tax position. We analyze clients’ financial situations, business structures, and transactions to identify potential deductions, credits, exemptions, and incentives that can reduce tax liabilities. We develop strategies to maximize tax benefits while maintaining compliance with tax laws.

We help businesses determine the most advantageous entity structure based on their specific circumstances. We assess the tax implications of different entity types, such as sole proprietorships, partnerships, corporations, or limited liability Partnerships (LLPs). We consider factors such as liability protection, ease of operation, and tax advantages to recommend the optimal entity structure.

We assist businesses with international operations in navigating the complexities of cross-border taxation. We help clients understand international tax treaties, transfer pricing rules, foreign tax credits, and other international tax considerations. We develop strategies to minimize the impact of double taxation and optimize the allocation of income across jurisdictions.

We provide guidance on tax considerations related to mergers, acquisitions, and corporate restructuring. We assess the tax implications of these transactions and develop tax-efficient structures to minimize tax liabilities. They assist in due diligence, tax planning for integration or divestiture, and post-transaction compliance.

We work with individuals and families to develop estate and succession plans that minimize estate taxes and facilitate the smooth transfer of assets to the next generation. We help clients utilize estate planning tools such as trusts, wills, and gift strategies to preserve wealth and address generational wealth transfer objectives.

We provide support during tax assessments and assist in managing tax controversies with tax authorities. We represent clients in negotiations, respond to inquiries, and help resolve disputes effectively. We manage and provide guidance on tax dispute resolution strategies, including negotiation, mediation, or litigation and represent clients for Tax Appeals before Commissioner Appeals and Tax Tribunal.

We offer educational programs and training to individuals and businesses to enhance their understanding of tax regulations, changes, and planning opportunities. We conduct workshops, seminars, or customized training sessions to increase clients’ tax awareness and empower them to make informed tax decisions

Publications

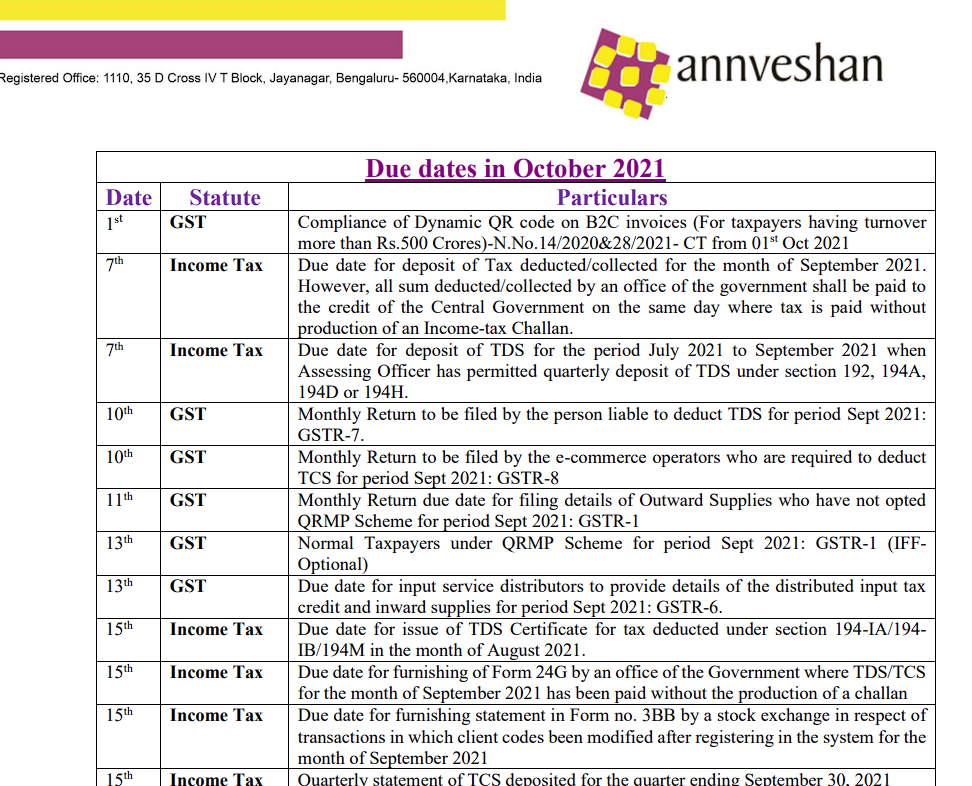

Spotted & Reported – Volume 2 – Issue 1

Know More

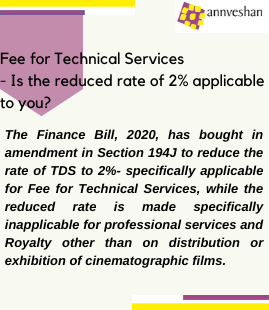

Fee for Technical Services – Is the reduced rate of 2% applicable to you?

Know More

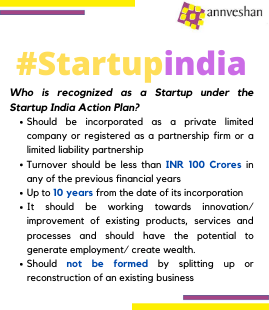

Startupindia

Know More

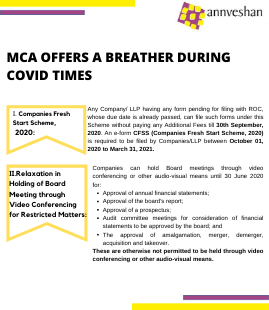

MCA OFFERS A BREATHER DURING COVID TIMES

Know More