Specialized International Tax and Cross-Border Transaction Services

These are specialized services that assist businesses in navigating the complexities of international taxation and conducting transactions across borders. These services are typically provided by tax experts, international tax consultants, or accounting firms with expertise in international tax laws and regulations.

International tax and cross-border transaction services help businesses navigate the complexities of international taxation, mitigate tax risks, and optimize tax efficiency in cross-border operations. By leveraging the expertise of tax professionals specializing in international tax matters, businesses can ensure compliance with tax regulations, minimize tax liabilities, and optimize their global tax position.

-

Tax Planning for

Cross-border Transactions - Transfer Pricing

-

Double Taxation

Avoidance -

Tax Compliance

and Reporting -

Permanent Establishment (PE) /

Significant Economic Presence

(SEP ) Analysis - Cross-border Tax Advisory

-

Withholding Tax Analysis

and Optimization - Tax Due Diligence

- Repatriation of Profits

-

Country-specific

Tax Advice

We help businesses develop tax-efficient structures and strategies for cross-border transactions, such as mergers and acquisitions, joint ventures, licensing agreements, and international expansion. We analyze the tax implications of different transaction structures and jurisdictions to minimize tax liabilities and optimize the overall tax position.

We assist businesses in establishing and documenting transfer pricing policies that comply with local regulations and international standards. Transfer pricing refers to the pricing of goods, services, and intellectual property transferred between related entities in different countries. Professionals help determine appropriate transfer prices, conduct transfer pricing studies, and ensure compliance with local transfer pricing regulations.

We help businesses navigate double taxation issues that arise when income is subject to tax in multiple jurisdictions. We analyze tax treaties, tax credit provisions, and other mechanisms to mitigate double taxation and ensure that businesses are not subjected to excessive tax burdens.

We assist businesses in meeting their tax compliance obligations in multiple jurisdictions. This includes preparing and filing tax returns, complying with local tax regulations, and maintaining proper documentation to support cross-border transactions. We stay updated on changes in tax laws and reporting requirements across certain important different jurisdictions.

We help assess whether a business has a PE or SEP or taxable presence in a foreign jurisdiction. We analyze the activities conducted by the business in each jurisdiction and evaluate the potential tax consequences. This analysis is crucial to determine the allocation of profits and the filing requirements in each jurisdiction.

We provide ongoing tax advisory services to businesses engaged in cross-border activities. They assist in interpreting and applying international tax laws, providing guidance on complex tax issues, and offering solutions to minimize tax risks and exposures.

We analyze withholding tax obligations on cross-border payments, such as dividends, interest, royalties, and service fees. We help businesses understand the applicable withholding tax rates, exemptions, and treaty provisions to optimize cash flow and reduce tax leakage.

We perform tax due diligence reviews in cross-border transactions to identify potential tax risks, exposures, and opportunities. We assess the tax positions of target companies, analyze historic tax compliance, and uncover any potential tax contingencies or liabilities.

We provide guidance on the tax-efficient repatriation of profits earned in foreign jurisdictions. We assist in developing strategies to minimize tax impact, optimize cash flow, and comply with foreign exchange regulations and repatriation restrictions.

We offer country-specific tax advice, taking into account the tax laws, regulations, and practices of different jurisdictions. We help businesses understand the tax implications of doing business in specific countries, including tax rates, incentives, customs duties, and other relevant tax considerations

Publications

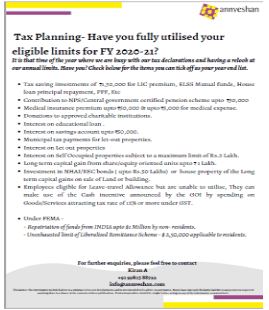

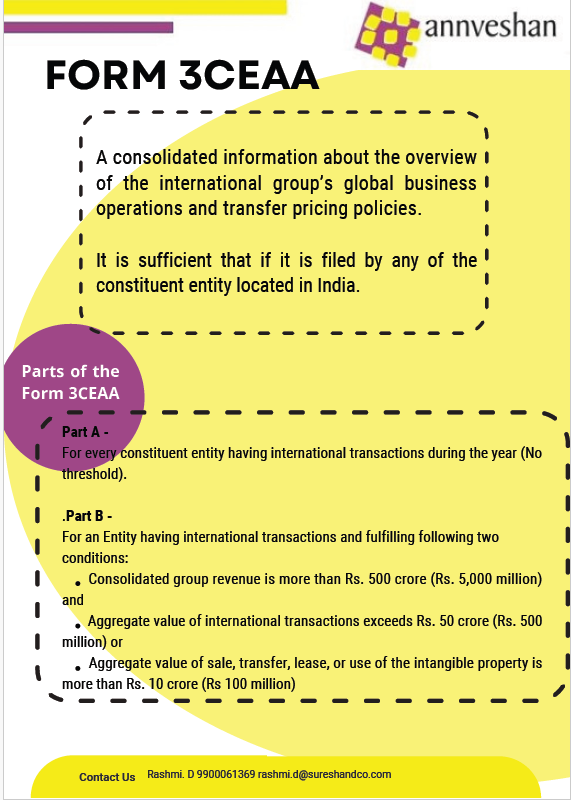

Master file (Form 3CEAA) filing requirements

Know More

Labour Codes & Its Impact on Business

Know More

Have you claimed your Foreign Tax Credit?

Know More

APPLICABILITY OF NUMBER OF DIGITS OF HSN CODE BASED ON TURNOVER

Know More