GST ( Goods & Services Tax ) Services

Comprehensive Solutions for GST Compliance and Optimization

- GST Registration

- GST Compliance

-

GST Advisory and

Consulting -

GST input credit

optimization -

GST Planning and

Optimization - GST Audits and Investigations

- GST Refund Claims

-

GST Training and

Education -

GST Implementation and

System Support -

GST Health Checks

and Reviews - Cross-Border GST

We assist businesses in registering for GST with the relevant tax authorities. We ensure that businesses meet the registration requirements, gather the necessary documentation, and complete the registration process accurately and timely.

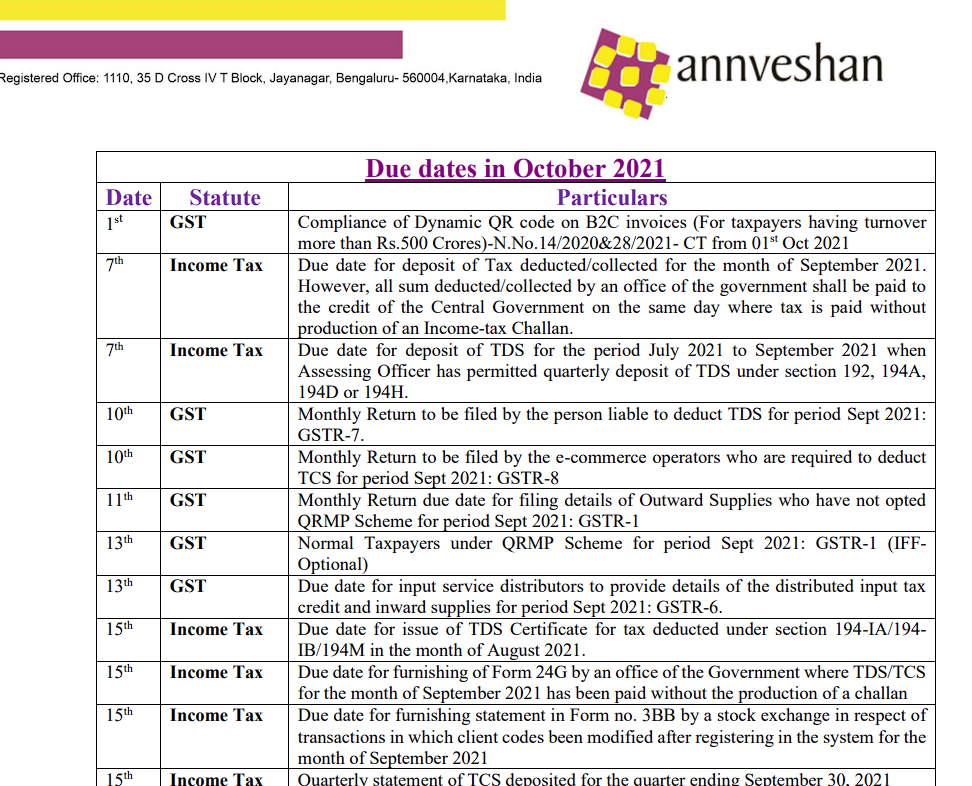

We help businesses comply with GST regulations by ensuring proper accounting, record-keeping, and reporting of GST transactions. We assist in preparing and filing GST returns, maintaining relevant documentation, and ensuring compliance with GST rules and deadlines.

We provide guidance and advice on GST matters. We help businesses understand the applicability of GST to their specific transactions, interpret complex GST regulations, and provide clarity on GST-related issues. We assist in navigating GST implications for various business activities and transactions.

We provide strategic guidance on management and utilization of input tax credits (ITCs) to minimize the overall GST liability of a business. It involves maximizing the claimable ITCs on eligible input goods and services while ensuring compliance with GST regulations. Optimizing GST input credit requires diligent record-keeping, compliance with GST regulations, and a proactive approach to identify opportunities for maximizing ITC. We support in effectively managing input tax credit, through which businesses can reduce their GST liability, improve cash flow, and ensure compliance with GST laws.

We work with businesses to develop strategies that optimize their GST positions and minimize the impact of GST on their operations. We analyze business processes and transactions to identify opportunities for GST planning, such as input tax credit optimization, tax-efficient supply chain management, and structuring of transactions to reduce GST liabilities.

We provide support and representation during GST audits and investigations conducted by tax authorities. We assist in gathering and organizing relevant documents, responding to queries from tax authorities, and resolving any discrepancies or issues that may arise during the audit process.

We assist businesses in claiming GST refunds for eligible transactions. We analyze the criteria and documentation requirements for GST refunds, prepare and submit refund claims, and liaise with tax authorities to ensure timely processing of refund applications.

We offer training programs and workshops to businesses and their staff to enhance their understanding of GST regulations and compliance requirements. We provide updates on GST law changes, educate businesses on proper GST practices, and help them stay informed about their GST obligations.

We provide support during the implementation of GST systems and processes within businesses. We assist in evaluating and selecting GST software solutions, configuring GST-related modules, and ensuring proper integration with existing accounting and ERP systems.

We conduct GST health checks and reviews to assess businesses’ compliance with GST regulations and identify potential areas of risk or non-compliance. We review GST processes, systems, and documentation to ensure businesses are effectively managing their GST obligations and minimizing exposure to penalties or assessments.

We assist businesses engaged in cross-border transactions in understanding and managing GST implications. We provide guidance on GST regulations for import and export activities, GST treatment of international services, compliance with GST reporting requirements for cross-border transactions, and claiming input tax credits for eligible foreign GST paid in applicable cases.

Publications

INDIRECT TAX

Know More

GST on the Residential Dwelling rented to Registered Tax Person Under GST

Know More

GST ON DIRECTOR’S REMUNERATION

Know More

SECRETARIAL AUDIT

Know More

Startupindia

Know More

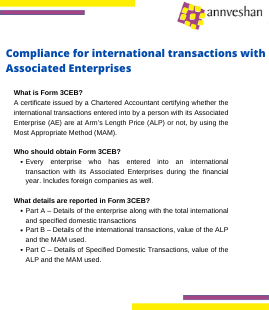

Compliance for international transactions with Associated Enterprises

Know More

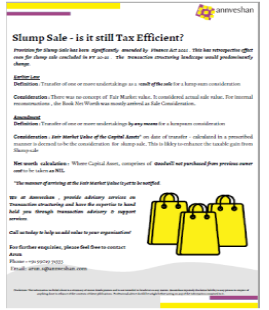

Slump Sale -is it still Tax Efficient?

Know More

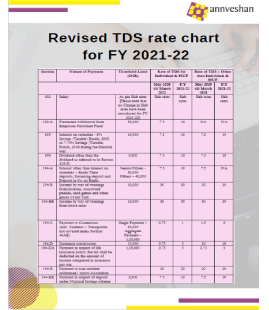

Revised TDS rate chart for FY 2021-22

Know More

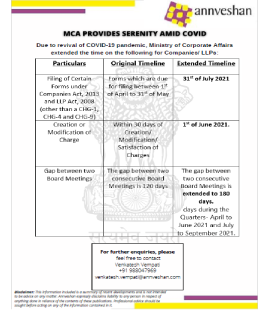

MCA PROVIDES CERENITY AMID COVID

Know More

Madras High Courts decision : GST impact for Resident Welfare Associations

Know More

E-Invoicing for Business with Turn Over above 20Cr ( W.E.F 01-Apr-2022) Are You Ready for It?

Know More

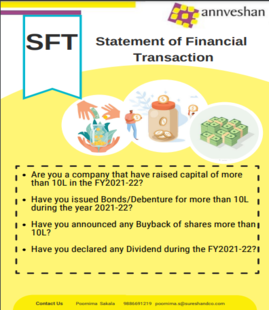

Statement of Financial Transaction

Know More

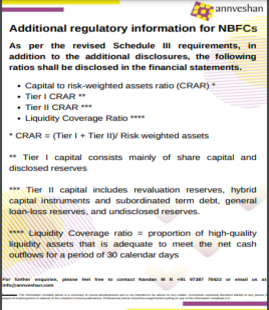

As per the revised Schedule III requirements, in addition to the additional disclosures, the foll...

Know More

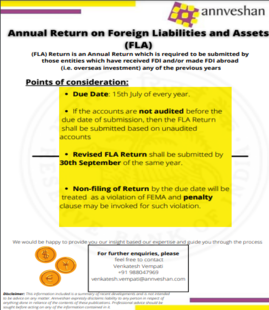

(FLA) Return is an Annual Return which is required to be submitted by those entities which have r...

Know More

Weekly Update – 1

Know More

Weekly Update – 2

Know More

Notifications to give the effect of the Recommendation of 47th GST COUNCIL MEETING

Know More