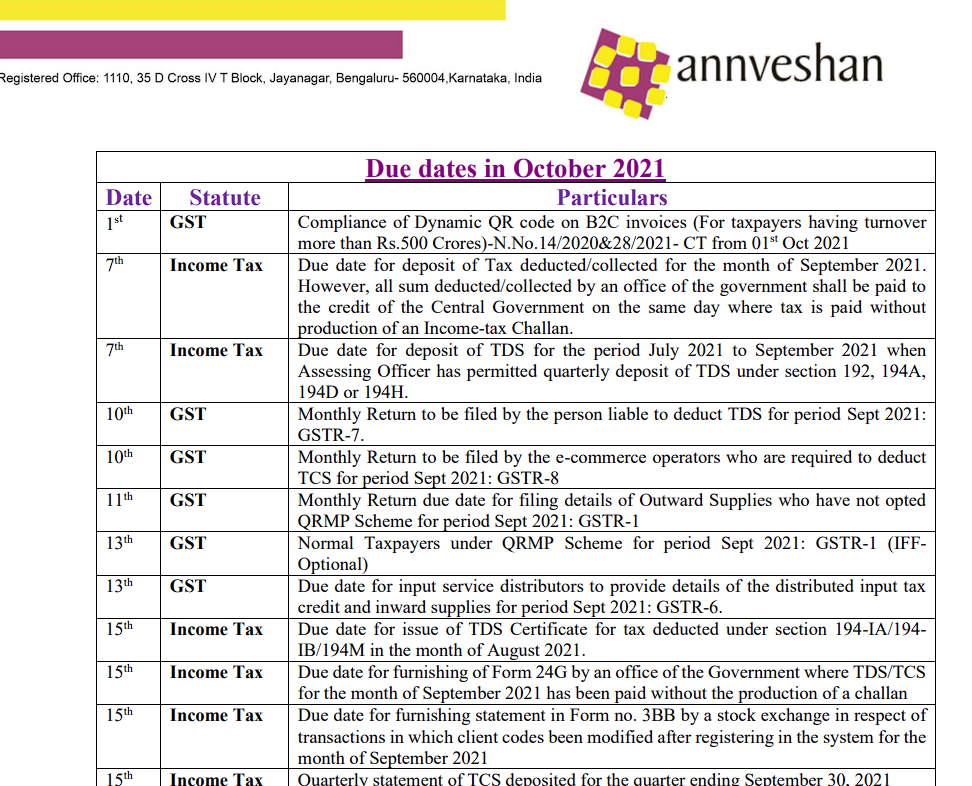

Services

Experts in Business Valuation Services

Business valuation services involve determining the economic value of a business or its assets. These services are typically sought for various purposes, including mergers and acquisitions, financial reporting, taxation, litigation, shareholder disputes, and strategic decision-making. As Business valuation experts, we use different methodologies and approaches to assess the value of a business based on its financial performance, market conditions, industry trends, and other relevant factors.

Business valuation services are critical in providing an objective and independent assessment of a business’s worth. We help stakeholders make informed decisions, negotiate transactions, resolve disputes, and comply with financial reporting and taxation requirements.

- Valuation Methods

- Financial Analysis

- Market Research

- Risk Assessment

- Valuation Reports

- Due Diligence

-

Scenario Analysis and

Sensitivity Testing -

Expert Witness

Services

We employ various methods to determine the value of a business, including:

- Income Approach: This method estimates the value of a business based on its expected future cash flows, applying techniques such as discounted cash flow (DCF) analysis or capitalization of earnings.

- Market Approach: This method compares the subject business to similar businesses that have been sold in the market, using multiples such as price-to-earnings (P/E), price-to-sales (P/S), or price-to-book (P/B) ratios.

- Asset Approach: This method determines the value of a business by assessing its net asset value, considering tangible and intangible assets, liabilities, and goodwill.

We conduct a thorough analysis of the business’s financial statements, including income statements, balance sheets, cash flow statements and such similar forecasts. We examine revenue and expense trends, profitability, liquidity, and capital structure to gain insights into the financial performance and risk profile of the business.

We use industry research and market conditions in which the business operates. We assess factors such as market growth, competition, regulatory environment, and economic trends to evaluate the business’s position and outlook relative to the market.

We evaluate the risks associated with the business, including industry-specific risks, competitive landscape, legal and regulatory risks, and financial risks. We consider factors such as customer concentration, technological changes, market volatility, and operational risks that may impact the value of the business.

We prepare comprehensive reports that document the valuation process, methodologies used, assumptions made, and the final value conclusion. These reports are typically used for transaction pricing , financial reporting purposes, legal proceedings, and stakeholder communication.

Valuation services often involve conducting due diligence to gather relevant information about the business, including historical financial data, legal agreements, customer contracts, intellectual property, and operational details. This helps ensure a comprehensive understanding of the business’s assets, liabilities, and potential risks.

We perform scenario analysis and sensitivity testing to assess the impact of different assumptions and variables on the value of the business. This analysis helps stakeholders understand the potential value range and the sensitivity of the valuation to key factors.

We provide expert witness services in legal proceedings such as litigation, shareholder disputes, or divorce cases. We offer expert opinions on the value of a business or its assets, and may testify in court to support our valuation conclusions.