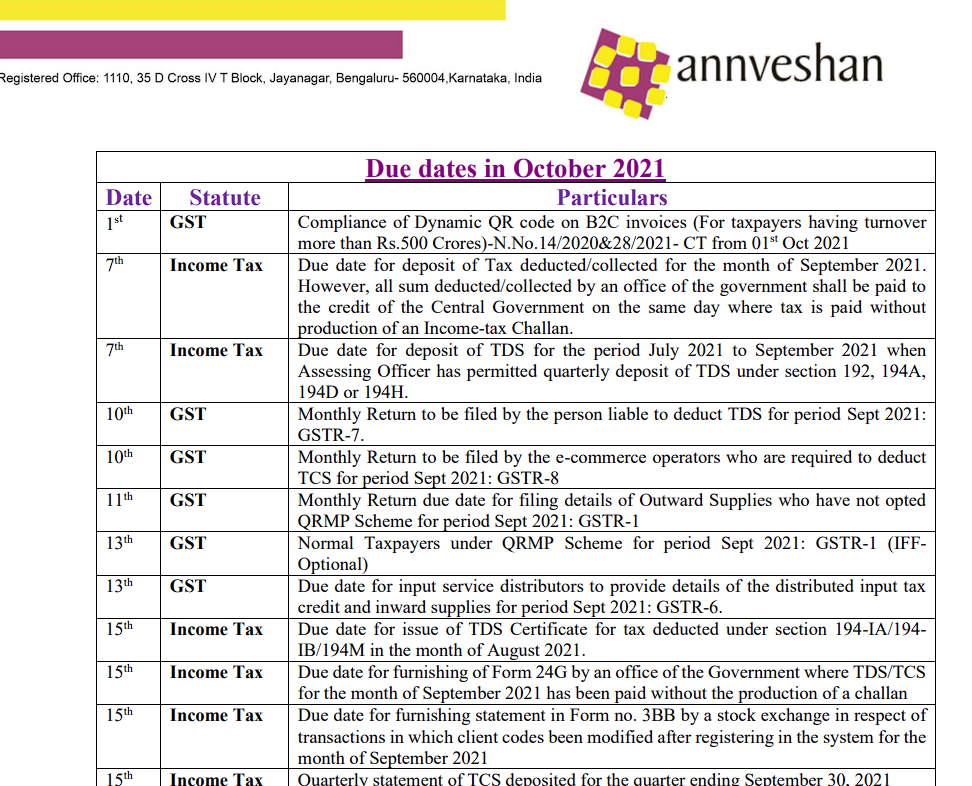

Best finance service providers in Bangalore

-

Tax Exemption and

Compliance - Grant Compliance

- Financial Management

-

Fundraising and Donor

Compliance - Regulatory Compliance

-

Financial Reporting

and Audit -

Grant Proposal and

Budget Development -

Risk Assessment and

Management -

Capacity Building

and Training -

Strategic Financial

Planning

Assist NGOs in obtaining and maintaining tax-exempt status, such as Sec 11 & 12 status in India and obtaining registration under Sec 80G for giving the donor tax benefits . We guide organizations through the application process, provide advice on meeting compliance requirements, and help prepare and file tax returns specific to non profit entities.

NGOs often rely on grants and funding from governmental agencies, foundations, or other sources. We help ensure compliance with grant requirements, including financial reporting, tracking expenses, maintaining proper documentation, and meeting performance milestones.

We assist NGOs in developing effective financial management systems and processes. We provide guidance on budgeting, financial planning, and cash flow management. We also help establish internal controls, policies, and procedures to ensure transparency, accountability, and proper stewardship of funds.

We assist NGOs in navigating fundraising regulations and best practices. We help organizations comply with donor reporting requirements, disclosure regulations, and ethical standards for soliciting and managing donations. We also provide advice on diversifying funding sources and developing fundraising strategies.

We help NGOs understand and comply with regulatory frameworks specific to the nonprofit sector including FCRA Compliance, Sec 8 Company compliance . Registration for CSR Funds , Darpan Registration , Registration on Social Stock Exchange (SSE ) .

We assist NGOs in preparing accurate and timely financial statements, including statement of activities, statement of financial position, and cash flow statements. We ensure compliance with accounting standards for nonprofits, and we also coordinate and support the annual audit process.

We provide guidance in developing comprehensive grant proposals and budgets that align with the organization’s mission and meet the requirements of funding opportunities. We assist in financial projections, cost allocation methodologies, and developing effective budget narratives.

We help NGOs identify and mitigate financial and regulatory risks. We assess internal controls, recommend improvements, and develop risk management strategies to safeguard assets, prevent fraud, and ensure compliance with applicable laws and regulations.

We offer training programs and workshops to enhance the financial literacy and management skills of NGO staff and board members. These sessions cover topics such as financial planning, budgeting, grant compliance, and financial reporting, empowering the organization to operate more effectively.

We work with NGOs to develop strategic financial plans aligned with their mission and long-term goals. We assist in assessing the financial sustainability of programs, exploring revenue diversification strategies, and optimizing resource allocation to maximize impact