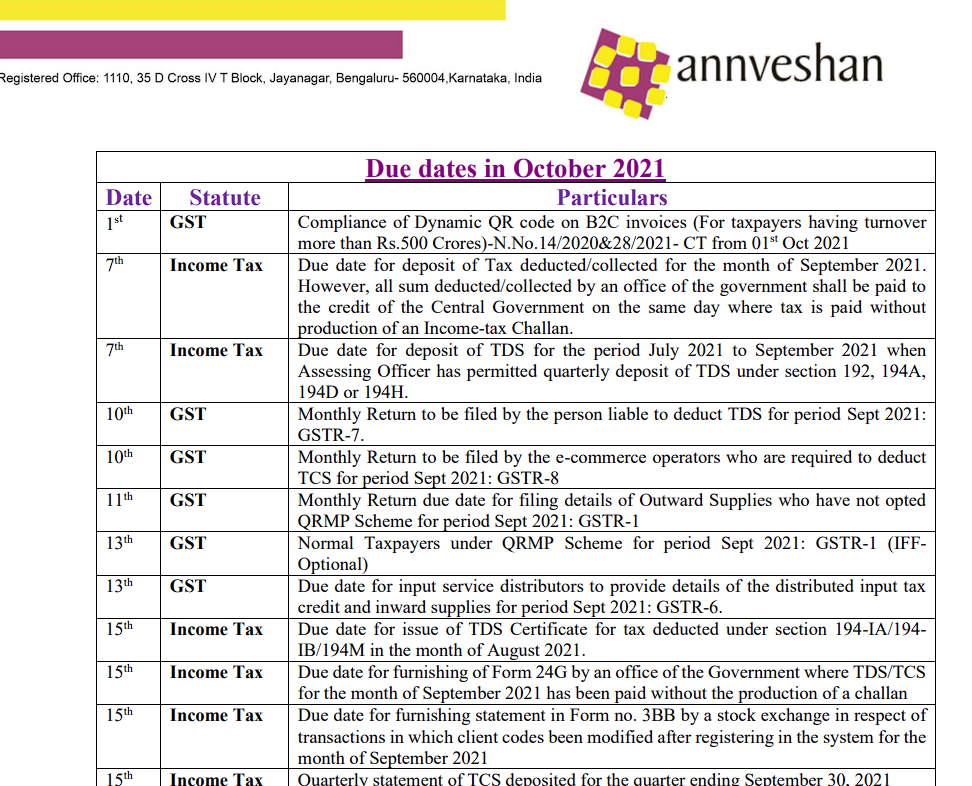

Mergers & Acquisitions (M & A)

Transaction Support Services

Maximizing Value through Effective M&A Transaction Support

- Due Diligence

- Financial Analysis

-

Valuation and

Deal Structuring -

Transaction Modeling

and Projections -

Risk Assessment

and Mitigation -

Tax and Legal

Considerations -

Transaction Documentation

and Execution

We conduct extensive due diligence on the target company to assess its financial, operational , contractual and regulatory aspects. We review financial statements, contracts, intellectual property, customer and supplier relationships, compliance records, and other relevant information to identify potential risks, liabilities, or undisclosed issues.

We analyze the financial performance and prospects of the target company. We assess financial statements, key financial metrics, revenue and cost drivers, profitability, cash flow, and working capital considerations. This analysis helps evaluate the financial health, value, and potential synergies of the target.

We assist in valuing the target company or the assets involved in the transaction. We employ various valuation methodologies, such as discounted cash flow (DCF), comparable company analysis, or transaction multiples, to determine a fair value range. We also provide guidance on deal structuring, considering factors like consideration mix, earn-outs, contingent payments, and other transaction terms.

We develop financial models and projections to assess the potential impact of the M&A transaction. We create scenario analyses, sensitivity testing, and integration models to evaluate the financial implications and synergies of combining the two entities. These projections aid in decision-making and negotiations.

We identify and assess the risks associated with the transaction. We evaluate potential legal, regulatory, operational, market, and financial risks that could impact the success of the transaction or the merged entity. We provide recommendations and strategies to mitigate these risks.

We address tax and legal aspects of the M&A transaction. We assess the tax implications, structuring options, and potential tax benefits or risks. We also assist in co ordination of reviewing and negotiating legal agreements, ensuring compliance with applicable laws and regulations.

We provide support in preparing and reviewing transaction-related documentation, such as letters of intent, Term sheets , share purchase/ subscription agreements, disclosure schedules, and other legal documents. We coordinate with legal counsel and assist in managing the execution of the transaction.